In the banking sector, the use of digital or digital technology is an unavoidable trend that aims to provide the best customer experience while also expanding the market, increasing revenue, and lowering operating expenses.

Customers are gradually altering their banking habits with higher expectations and a desire for novel experiences with faster and more convenient processing times.

More than 2,000 businesses were surveyed for the PwC Industry 4.0 Global Survey 2016, which found that when technology is used in operations and new customers are found, the average annual operating cost of the business decreases by 3.6%, or 421 billion USD.

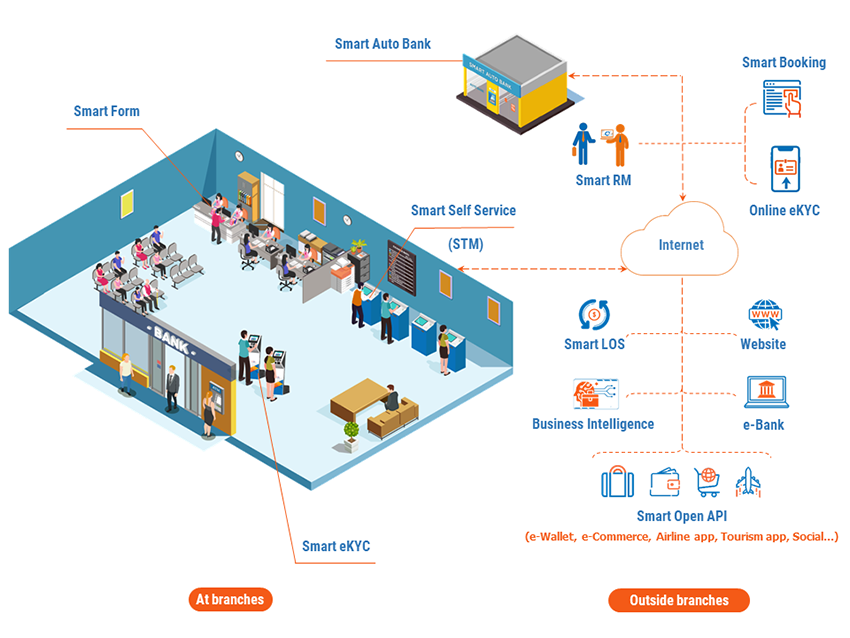

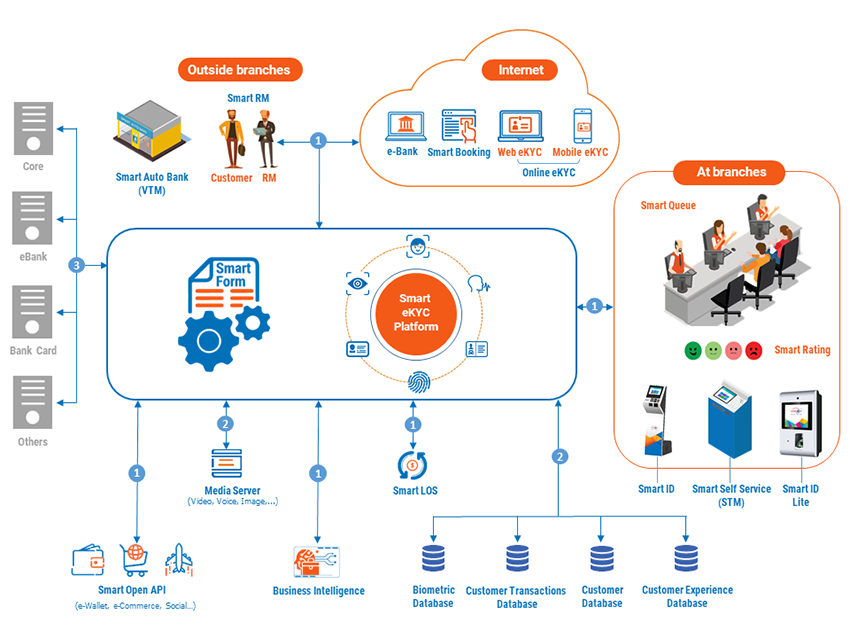

As part of the bank’s digital transformation, Hyperlogy developed the complete digital banking solution known as SMART DIGITAL BANK, which includes the following main components: Smart Form, SMART Booking, Smart eKYC, Smart RM, Smart LOS, e-Banking… where Saigon-Hanoi Commercial Joint Stock Bank (SHB), Military Commercial Joint Stock Bank (MB), An Binh Commercial Joint Stock Bank (ABBANK), South Korean TOSS (Viva Republica), and others have successfully implemented.

As part of the bank’s digital transformation, Hyperlogy developed the complete digital banking solution known as SMART DIGITAL BANK, which includes the following main components: Smart Form, SMART Booking, Smart eKYC, Smart RM, Smart LOS, e-Banking… where Saigon-Hanoi Commercial Joint Stock Bank (SHB), Military Commercial Joint Stock Bank (MB), An Binh Commercial Joint Stock Bank (ABBANK), South Korean TOSS (Viva Republica), and others have successfully implemented.

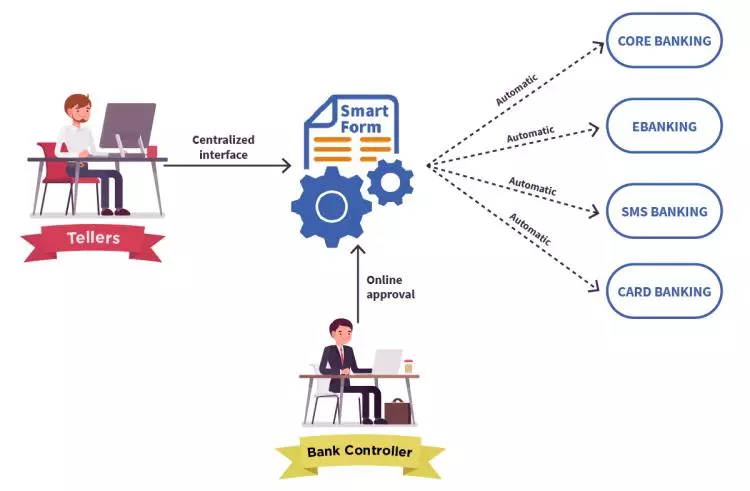

SMART FORM – a Dynamic e-form & Consolidation Solution

SMART FORM – a Dynamic e-form & Consolidation Solution

Is the supporting software system:

– Automatically fill in business function screens based on the teller’s information selection;

– Self-generated the form of transaction contract with customers;

– Support for approval on SMART FORM instead of approval on paper;

– Integrate with CRM to get customer information to display profiles 360 on the screen;

– Support statistical reports, SLA (Service Level Agreement),…;

– Integrate with SMART eKYC, SMART QUEUE, initiate transaction.

SMART FORM has been deployed to SHB, nearly 300 transaction points of MBBANK, and nearly 200 transaction points of ABBANK, reducing the average transaction time from 35 minutes to 5 minutes.

SMART Booking – Make booking service more conveniently

– Connect with SMART FORM and through SMART eKYC to identify registered customers present at transaction points;

– Connect with SMART FORM and through SMART eKYC to identify registered customers present at transaction points;

– Help customers register for transactions (Deposit, Withdrawal, Transfer money inside/outside the system …), enter information, select transaction locations, and make an appointment before coming to the bank via the Internet or application mobile;

– QR Code is generated after the transaction is registered;

– Scan the QR code on the SMART eKYC when arrival the bank to queue up the specified flow.

SMART Booking has also been successfully deployed by Hyperlogy at MBBANK and ABBANK.

SMART ID – an Easy Customer Identity Process

Is the device located at the transaction counter:

– Early identification of customers through QR Code, ID card, ATM card, EMV / EMV Contactless chip card, and NFC (Samsung Pay) to identify customers via Biometrics (face authentication, fingerprint);

– Integrated with SMART QUEUE for queue management: segmenting customers according to each business and customer group (VIP, online, and general);

– Extracting ID information automatically (letters, photos, fingerprints) pushed into SMART FORM.

Key benefits of SMART DIGITAL BANK

For the bank

– Reduce transaction time to 5 minutes, increase customer service capabilities, and increase labor productivity;

– Reduce transaction time to 5 minutes, increase customer service capabilities, and increase labor productivity;

– Optimized operation, easy to control risks, centralized customer data on a system to avoid record risks;

– Control quality of service (SLA – Service Level Agreement) based on detailed transaction reports, KPI of Teller, RM, Bank Controller in real time;

– 100% sell products in packages, increase service revenue;

– Save printing costs, and papers because the form is printed from the system and contains only information sections;

– Easy to expand to meet business requirements: register in batches, and choose a personalized account number…

For bank employees

For bank employees

– Identify and understand customers as soon as they arrive at the counter. Increase main sales, cross-sell, and package sales;

– Increase labor productivity 15 times, reduce the time to interact with professional systems, print, and approve;

– Have more time to advise clients;

– The teller uses only 1 electronic form for many services.

For customers

– 1-minute transaction instead of customers waiting in queue for a long time;

– Customers do not need to fill in multiple paper forms, only need to sign a single form printed by SMART FORM;

– Improving customer experience, providing multi-channel support.

Below is a description of the operation of SMART Booking, SMART FORM – SMART eKYC with different types of customers: New Customers, Regular Customers, and VIP Clients with respective transaction activities.

Contact to learn more about SMART DIGITAL BANK

-

How to use Machine Learning in Credit Scoring

March 12, 2018 -

SMART FORM technology helps to open a bank account in just 3 minutes

November 14, 2017