Smart LOS - Loan origination management solution

Due to the fact that lending activities generate a significant portion of banks’ profits, credit process management is one of their most important functions.

Hyperlogy developed the solution Smart LOS to assist banks in optimizing the credit process, which includes expediting and accurately processing loan application documents and shortening customer service delivery times.

Integrating Smart LOS system in bank brings a variety of excellent advantages to customers and operations such as:

- Optimize transaction time with modern technology integrated on the system

- Save operating costs in the bank

- Improve bank productivity and efficiency

- Track customer’s loan life cycle according to a unified process to improve loan processing quality

- Support the ability to check and monitor credit to help reduce risks in the loan approval process

- Improve transparency and modern security system, hosted in the cloud

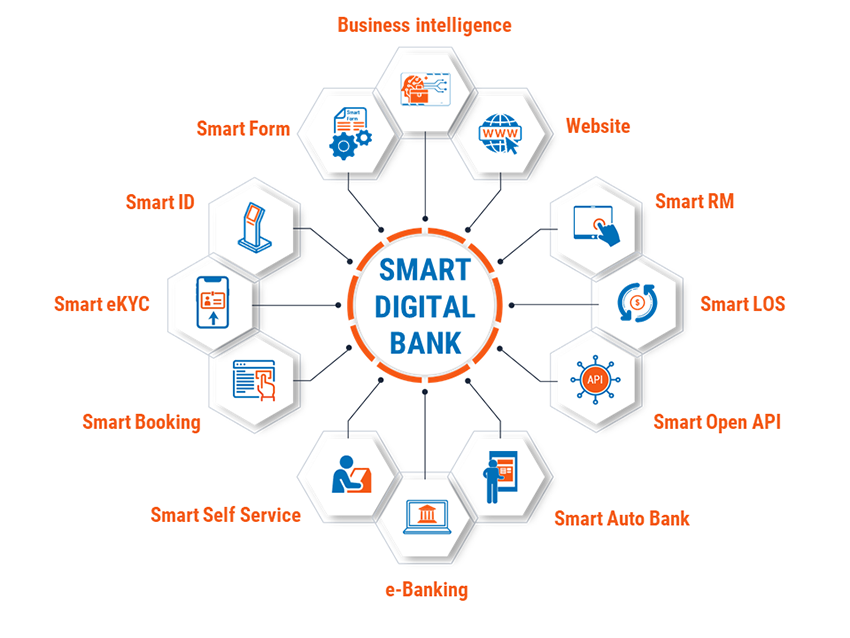

Smart LOS integrated directly with Smart RM in Hyperlogy’s Smart Digital Bank ecosystem, helping to speed up the loan approval process from when a customer relationship officer (RM) contacts customers with loan needs until the credit process is completed.

This brings customers a convenient and efficient loan experience at bank.

In order to provide customers with the most cutting-edge service possible, banks need to keep their systems up to date and incorporate technological advancements into them.

Hyperlogy offers cutting-edge, adaptable technology through a group of knowledgeable engineers. Smart LOS makes a scientific, cutting-edge, and efficient contribution to the bank’s credit procedure.

-

Hyperlogy deployed SMART eKYC solution for Phu Hung Securities

February 23, 2021