- February 2, 2023

- Posted by: Đào Nhật Minh

- Category: Technology news

In today’s modern society, banks must quickly undergo a digital transformation if they do not want to reenter the market. This is due to the rapid growth of information technology. As a result, implementing E-Banking in the bank is a useful strategy for enhancing customer service and optimizing operations.

What is e-Banking?

E-Banking is software for electronic banking that lets customers get services quickly and effectively without having to go to the bank’s counter.

The bank’s e-Banking application has given the banking service in Vietnam a new lease on life. Customers can easily conduct transactions using internet-connected desktops, laptops, tablets, and even mobile devices with e-Banking. This not only reduces transaction costs and time, but it also improves the customer experience when making bank transactions.

Three outstanding advantages of using e-banking in banks

Optimizing time and costs

Customers can expedite their financial transactions by utilizing the e-Banking service, which features an intuitive user interface and straightforward operations.

Additionally, e-Banking has been updated to include a variety of quick payment options, including the ability to receive funds through customs transactions and transfer funds using an account number or phone number. Customers can save time and effort by not having to make direct bank transactions thanks to this. In addition, e-Banking frequently offers customers appealing promotions.

High security

OTP code authentication will guarantee the safety and security of e-Banking transactions in order to help customers avoid and reduce risks associated with financial transactions.

With high security, e-Banking solutions are often preferred by businesses for business transactions such as payment of fees, corporate taxes, salary transfers to employees, financial transactions with partners, or other financial transactions in the enterprise.

Maximizing customer experience

e-Banking provides a variety of services to customers, and customers can use e-Banking to pay for securities and insurance investments. This allows customers to integrate different services on the same system to help the process of checking and executing transactions take place in a consistent and optimal way.

In addition, customers who use e-Banking can immediately send complete feedback about banking services via the online platform. In the meantime, bank employees will be able to respond to questions quickly, which will increase customer satisfaction with the bank’s services.

Hyperlogy successfully implemented e-Banking for Banks

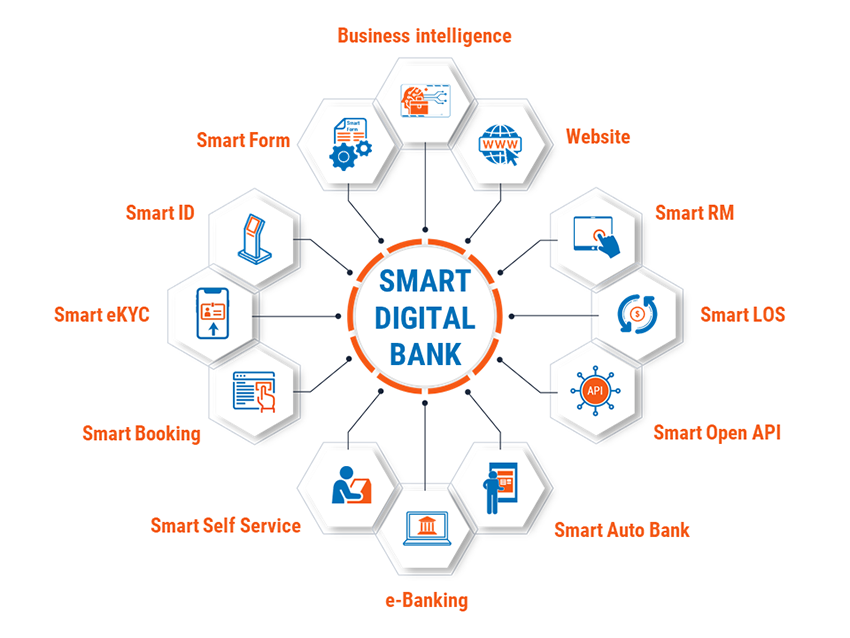

Hyperlogy has accompanied many banks on the journey of digital conversion with Smart Digital Bank, Hyperlogy successfully upgraded the e-Banking system for BAOVIET Bank at the website https://ebank.baovietbank.vn/ with a modern, user-friendly interface, and at the same time with a variety of related utilities to enhance the customer experience when using the bank’s service.

See also Hyperlogy application of the e-Banking system for BAOVIET Bank right here: