- January 18, 2021

- Posted by: Đào Nhật Minh

- Category: Hyperlogy news, Success stories

Under the influence of the industrial revolution 4.0, banks are increasing their investment in technology infrastructure, developing digital banking, utilizing Big Data and artificial intelligence (AI), and expanding business opportunities to provide customers with novel and cutting-edge experiences. Vietnam’s finance and banking sectors are the most active when it comes to implementing and utilizing technology solutions.

SHB aims to become a leading multi-functional digital retail bank in Vietnam

For SaiGon-HaNoi Commercial Joint Stock Bank (SHB), 2020 is a pivotal year, SHB made successful transformations in strategy, business model, organizational structure, to risk management, banking modernization, aiming to become a leading modern multi-functional digital retail bank in Vietnam with a vision to 2025 becoming a strong international financial group with modern technology infrastructure, professional human resources, nationwide and international network.

On the basis, SHB aims to focus on customers, transform mindset of staff into digital mindset to attract customers, increase revenue, sustainable profits, and increase labor productivity SHB gradually selects and implements a series of new technology solutions such as Customer Relationship Management (CRM), Enterprise Resource Planning Systems (ERP), Debt Collection Solution (Debt Collection), recent solution of Unified over-the-counter transactions – SMART FORM of Hyperlogy… All selected solutions meet the following criteria: Branded solutions, which have been successfully deployed in many large financial institutions, have been built on technology platforms, new and modern architecture, with AI application, capable of running on web browsers as well as lack of mobile devices, especially ensuring the requirements of information security, security and safety according to international standards.

SHB successfully implemented SMART FORM – An opportunity to expand the business, shorten a comprehensive digital transformation roadmap

Recently, Hyperlogy successfully go-live the project “Deploying SMART FORM for all non-financial operations at transaction counters” serving more than 530 domestic and foreign transaction points, more than 8,300 employees, more than 5 million individual and corporate customers, and 400 banks across continents.

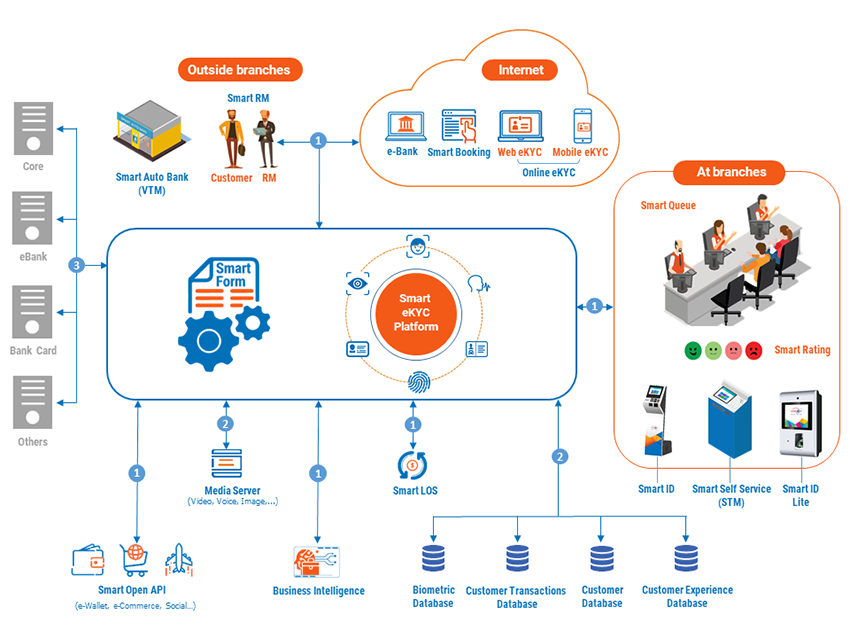

Taking advantage of SMART FORM system, right after SHB launched a new service – COMBO of payment accounts at SHB: S.Basic, S.More and S.Super for individuals and businesses customers. For SHB, it can be said that SMART FORM (also known as OneLink) is considered as a central software system that plays a very important role in modernizing and digitizing transactions at the counter of the bank.

Besides the benefits of promoting the sale of service packages, SMART FORM also helps SHB to save costs and resources, it will only take 3-5 minutes (excluding waiting time, scanning & approving documents) to make a transaction for a typical new customer, including opening an account, card, and registering normal value-added services (SMS / Internet / Mobile banking), compared with 20-40 minutes in the past. This means saving up to 80% of the time, equivalent to 5 times increase in labor productivity.

SMART FORM – the core component in the digital banking ecosystem, SMART DIGITAL BANK is also a solution implemented by Hyperlogy for An Binh Commercial Joint Stock Bank (AB), Military Commercial Joint Stock Bank (MB) and received the title of Sao Khue 2020 Top Excellent Products / Services in the field Banking, Finance, Accounting.