An Innovative Branch Teller eForm Application For Banks

KEY FEATURES

NONFINANCIAL

Customer profile 360

- Centralized customer profile

- Customer information history

- Show all services in one query

CIF

- Open/Update CIF information

- Register/Update relationship information (guardian, legal representative, ..)

Account

- Open/Update/Close accounts (current account, saving account, beautiful digital accounts, …)

- Register/Update general account information

- Register/Update account authorization information

eBanking

- Register/Update/Cancel SMS Banking

- Register/Update/Cancel Online Banking

- Register/Update/Cancel Mobile Banking

Card

- Issuing and updating domestic debit cards (Main card, Supplementary card)

- Issuing and updating international credit cards (Main card, Supplementary card)

- Card support (re-issuance of cards, change of limit, cancellation of cards, …)

Service combo

- Register/Update service combo

- Cancel the service combo

- Service combo fee

FINANCE

Deposits

- Open a passbook

- Finalize/withdraw part of the passbook

- Interest payment/transfer of ownership/mortgage loan/… passbook

Deposit/Withdrawal

- Deposit money into the Bank’s internal account (local currency, foreign currency)

- Account withdrawal (local currency, foreign currency)

Transfer money

- Cash transfer outside the bank

- Transfer within/outside the system

- NAPAS transfer 24/7

Service fee collection

- Fee collection in cash, bank transfer

- Western Union Service Fee Collection

- Insurance service fee collection

Cheque Service

- Cheque warehouse management

- Supply of cheque, crossed cheque

- Cheque payment guarantee

Other services

- Autopay service

- Insurance services

- Currency exchange

OTHER FUNCTION

ePrintouts

- Billet paper (deposit/withdrawal, cheque, passbook, …)

- Services registration/update/cancellation

- Statement (debit note, credit note, …)

- Printouts others

Report

- Service and transaction registration report

- SLA report

- Other reports

System management

- User administration and system authorization

- System directory management

- System configuration

- Monitoring system

Other function

- Manage attachments (eg: ID documents, contract scans, …)

- Manage signatures

- Centralized profile management (records in progress, pending, approved)

More convenient to improve customer satisfaction

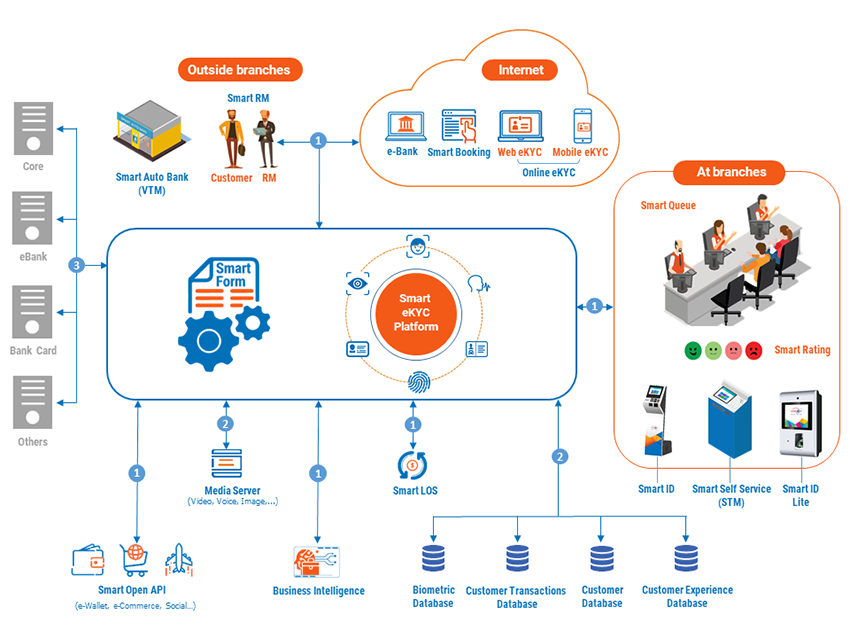

Due to the widespread coverage of 3G, 4G, and 5G networks and the low cost of telecommunication services in relation to income, the Internet and mobile devices have emerged as significant trading channels worldwide. The transformation of digital banking is also a trend. By submitting an application to the bank via SMART FORM, the procedures for opening payment accounts, cards, SMS Banking, and Internet Banking can be completed online, over the phone, or at any time. Additionally, customer satisfaction rises as a result of the speed with which SMART FORM expedites counter transactions.

Some transaction channels of Smart Form

Saving costs and resources

By improving and automating the process, SMART FORM assists banks in reducing the amount of time spent performing counter transactions by up to 80%.

- Smart Form was developed to eliminate customers from paper form filling. Forms are printed for customers to sign and can be entered directly into the SMART FORM system by teller.

- Tellers do not have to fill out multiple forms. Once the data is entered on the SMART FORM, it is automatically transferred to the appropriate systems, including the core system, the card system, Internet banking, and SMS banking,… via ESB. Additionally, this cuts down time & money.

Customers can also reserve a time slot at the branch by using Smart Booking, so your bank will:

- Enhance customer service.

- Reduce costs of paper and printing.

- Improve employees’ productivity and reduce labor costs.

Centralized database

The accurate and centralized entry of customer and service data is made easier with SMART FORM. Customer and service data are effectively managed, utilized, and updated as a result of this. The bank has access to sufficient information to make timely decisions thanks to the rapid compilation of customer and service reports.

Improving productivity

Relationship managers use a tablet to conduct online transactions simultaneously when they arrive at the customer’s location. The sales process can be completed quickly and easily using this method.

Enhancing the abilities of integration & expansion

Banks constantly need to develop new applications (such as integration with e-wallets, insurance services, and social networking) to compete in today’s technology-driven world. In addition to ensuring the safety and security of the entire system, this practical requirement requires the bank to rapidly modify its internal technology services. In this instance, SMART FORM is an intermediary system that makes it possible to connect new services (both for internal banking and external service providers) safely, easily, and quickly to the core systems.

Download SMART FORM brochure: HERE

Contact us to learn more about Smart Form

-

The ABBank CIO talked about Smart Form

November 22, 2020