- December 3, 2020

- Posted by: Đào Nhật Minh

- Category: Hyperlogy news

To increase the density of transactions of a specific customer, one of the most important things that banks need to pay attention to is improving the quality of customer service. When customers are more satisfied with the bank, they will transact more often. Hence, outstanding customer service is a must for developing sustainable relationships and increasing customer loyalty.

“Selling more than the customer’s original purchase plan” is what all service providers would want.

To promote superior services, banks often deploy a number of promotions such as:

– Boost cross-selling: A way to help customers have a better experience, increase satisfaction and prevent customers from using competitors’ products and services.

– Take advantage of up-selling opportunities: Selling more than customers originally planned to buy.

– Product bundling: Instead of selling a single product or service, the bank should pack many products and services. That makes it easy for employees to sell and also makes it easy for customers to choose.

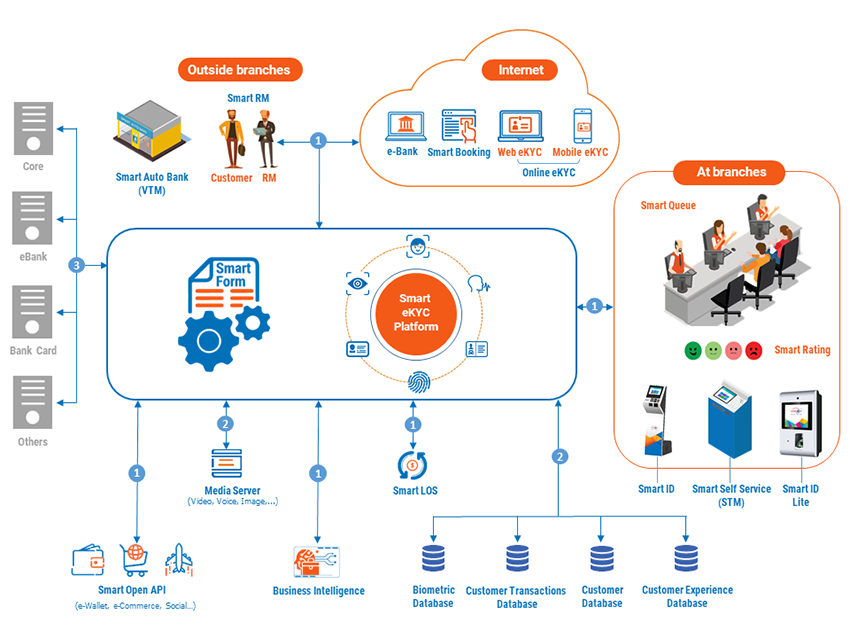

With the application of SMART FORM – Hyperlogy’s over-the-counter transaction consolidation solution, instead of selling single services (e.g. card opening), consultants & bank tellers can easily sell services bundling. For example, the “combo account” package includes a payment account, ATM card, VISA / Master Premium credit card, along with the following services: SMS Banking, Mobile Banking, and Internet Banking,… or a car finance package.

On that basis, banks can also promote bundling by customer segments. For example, packages of products and services for farmers, small businesses, civil servants, groups of customers receiving salaries via bank accounts, and students,…

In addition, product and service packages for employees/agents/distributors/end-users… can also be packaged with product or service packages for company customers to increase the attractiveness and add utilities. Thereby increasing the proportion of revenue from services.

Specifically, SMART FORM is a transaction-consolidation software platform that allows flexible definition and customization of product packages towards different customer groups. Accordingly, the customer relations department can proactively set up and modify business campaigns easily.

So far, SMART FORM has been deployed to nearly 300 banking transaction offices of MBBANK and nearly 200 banking transaction offices of ABBANK, reducing the average transaction time from 35 minutes to 5 minutes. A number of other banks have also taken advantage of SMART FORM to launch large preferential COMBO packages to stimulate customers’ demand for services during the Covid-19.