- May 13, 2021

- Posted by: Đào Nhật Minh

- Category: Press news, Success stories

Le Hai, CEO of ABBank, affirmed the long-term objective of ABBank is to become one of the top eight banks in Vietnam with the highest return on equity (ROE) in 2021 in an article that was published by CafeF. According to the General Director of An Binh Bank, the Smart Form solution developed by Hyperlogy for ABBank has brought about extremely good results. Smart Form helps reduce the transaction processing time to 5-7 minutes per transaction on average, contributing significantly to ABBank’s achievement to attract over 368,000 new customers, reduce operating costs by 300 billion VND per year, and account for more than 10 billion VND in service fees to ABBank’s profits.

___Excerpt from the Interview with CEO Le Hai:

ABBank has been focusing on digital transformation for the past two years. What are the results, Mr. Le Hai?

At the end of April, ABBank launched “Roadshow” campaign to introduce the AB Ditizen application to people in 15 major provinces and cities across Vietnam, with quite surprising results. On the first day of launch, we attracted 10,000 new users, and the number increased to 20,000 within just three days. A special feature of this app is that customers can open an account directly through the app without going to the bank. The account number is the same as the customer’s phone number, and all transactions are completely free of charge. ABBank aims to establish a digital bank that serves the needs of digital citizens, enabling customers to use banking services and personal utilities in the most convenient way. AB Ditizen not only provides benefits to customers but also helps reduce operating costs and generate revenue for the bank.

Regarding the digitalization of internal operations, the research and construction of Smart Form at bank counters have helped ABBank speed up transaction processing with customers, increasing over 18,000 transactions in the first three months of the year. Automatically issuing card/ supporting requests immediately upon receiving requests and integrating electronic form templates have helped reduce the average transaction processing time to only 5-7 minutes per non-financial transaction, such as registering for account opening services, card issuance, and electronic banking services for personal customers, corporate customers, and SMEs.

The initial digitalization of ABBank’s credit assessment process has received positive feedback, such as the application of automation features to optimize the workflow, reduce manual processing requirements at certain stages, and speed up the credit application process. This has helped to reduce the processing time by at least one-third and cut the number of steps from 42 to 22. In particular, reducing processing time by one-third has contributed to increasing productivity of document processing by at least 30%, providing a good experience for external and internal customers, thereby creating a foundation and motivation to attract more customers to use ABBank’s products/services.

What about digitalization in the bank’s internal operations?

Digitalization has two parts: the first one is customer orientation, for example, customers can install and utilize the bank’s mobile app. But a more important factor contributing to the success of a digital bank is being able to digitalize internal management processes. For ABBank, in its 5-year strategy, the bank will focus on digitalizing operational activities and processes to ensure that when customers use ABBank’s services, they can experience the fastest and most convenient service thanks to technology and AI.

For example, in 2020, ABBank made breakthroughs in digitalization, such as centralizing and applying IT into treasury operations, leading to a reduction of around 150 billion VND in surplus reserves, improving control of cash flows, and optimizing bank operations.

The second point is the development of the Smart Form system, which helps to minimize paper-based document processing right at counters, increasing the number of customers, reducing operating costs by 300 billion VND per year, making it easier for customers to search and explore information about products combos, and helping the bank to better identify customers through images, leading to faster transaction processing and reducing transaction costs and time by 50%. The third one is the digitalization of the credit assessment process, where all steps and document transfer stages are fastened, saving time and costs significantly, and especially increasing productivity and work efficiency so that people can process those documents from anywhere.

The results recorded in 2020, solely through improvements such as building Smart Form at counters and centralizing the treasury’s activities, have made a significant contribution to helping ABBank attract more than 368,000 new customers, and reduce service operation costs by up to 13%. Thanks to the reduced transaction time at counters, the number of transactions has increased, contributing over 10 billion VND in service fees to ABBank’s profits.

Through these clear figures, digitization is not just a story simply for ABBank, other banks are also implementing and will have to implement it to optimize their operations.

What is the specific strategy that the bank is heading to in the next 3-5 years?

An Binh Bank hopes to rank among the top 8 private banks in Vietnam for return on equity (ROE). It anticipates having 2 million individual customers, service revenue of at least 20%, and revenue from individual customers of at least 70% of total revenue.

Additionally, in the retail development direction for the next 5 years, ABBank will also implement activities to attract and expand customer groups to diversify its service revenue sources. This is also a common trend among Vietnamese banks today.

___Excerpt from an interview with ABBank’s CEO published on the CafeF website on May 12, 2021

https://cafef.vn/ceo-abbank-le-hai-an-binh-se-tap-trung-vao-2-du-an-lon-dat-muc-tieu-vao-top-8-ngan-hang-co-ty-suat-loi-nhuan-tren-von-tot-nhat-20210511175340989.chn

Hyperlogy is honored to accompany ABBank in achieving its strategic goals, making a breakthrough in the field of DIGITAL BANKING.

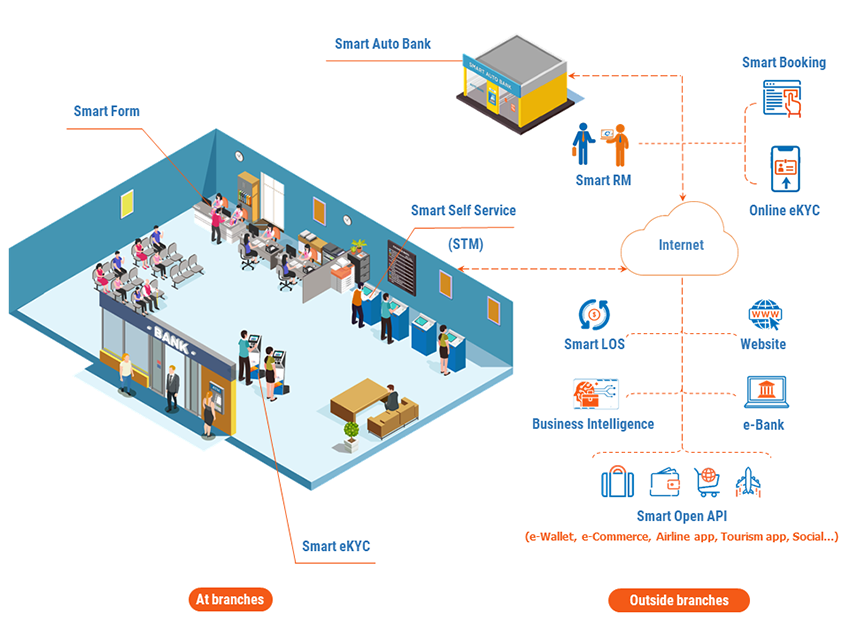

Find out more about Hyperlogy’s typical digital transformation solutions in the banking sector: Smart Form, Smart Self Service, and the SMART DIGITAL BANK ecosystem.