- February 23, 2019

- Posted by: Đào Nhật Minh

- Category: Technology news

Bank’s services better meet customer needs thanks to Digital Self-Service

Currently, many technology solutions have been strongly applied by banks. This brings customers’ expectations, wants to experience service from the bank. On the other hand, the constantly changing legal environment shows many limitations of ineffective old processes, has created new forms of competition in the banking sector.

Ahead of the Digital Transformation trend, many banks, especially in the US, have quickly responded to customer expectations by providing them with a number of online self-service tools. However, for some services, customers still choose to go to a bank branch or ask for phone support.

According to PWC’s survey on Digital Banking 2018, 60% of customers sharing a bank branch with a convenient location is very important. This survey also shows that some of the transactions customers prefer to do at the counter are:

– 59%: Register a loan

– 58%: Open a new account

– 43%: Open new investment account

– 37%: Use financial consulting services

Many large banking institutions have risked customer loyalty, struggled to create habits for customers to use the service by new methods, reduce transaction load at the counter, improve the experience, and increase revenue.

Digital Self-Service is the solution that we want to mention. With this method, in addition to the above objectives, banks can also build trust for customers to switch to new technology platforms, completely replacing the old method.

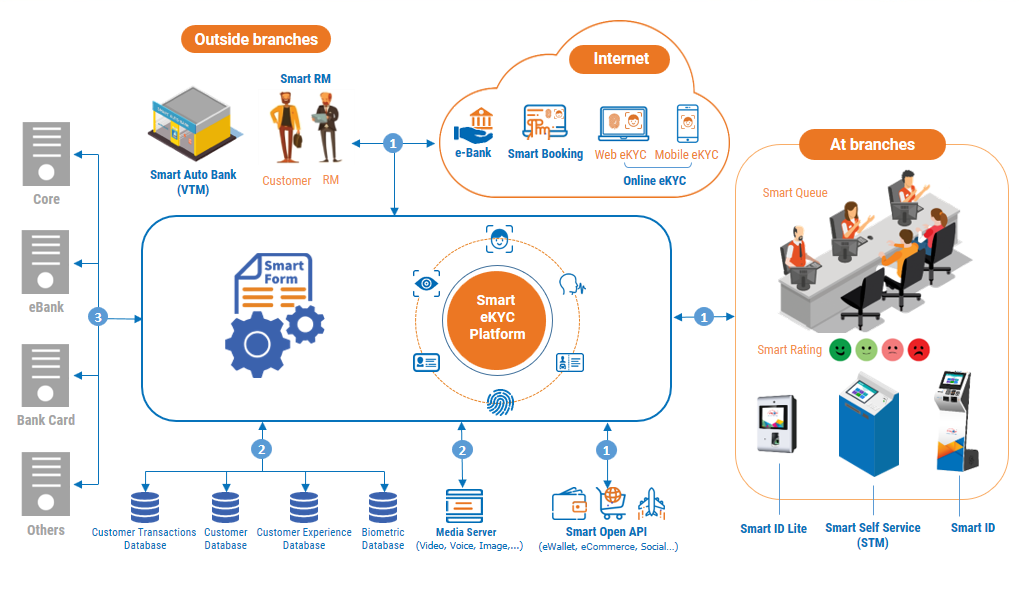

In Vietnam, Hyperlogy is one of the leading units in the construction and development of technology solutions in the direction of Digital Self-Service. We have built a series of breakthrough technology solutions with a number of advanced facilities in the SMART BANK ecosystem:

- SMART eKYC: A solution to help the Bank understand customers (Know Your Customer); 15 times increase in labor productivity; Only 1 minute of banking transaction;

- BANK Internet Check-in: Providing online banking service for customers.

- MOBILE eKYC: Applying Biometrics Authentication on mobile – Helping banks improve customer experience.

It can be said that the traditional way of serving customers in the banking industry has become inappropriate and does not meet the requirements of a new generation of tech-savvy customers. Therefore, to retain customers, improve customer experience, reduce costs, and increase revenue and profit, banks should consolidate with technology solutions that meet the inevitable trend – Digital Banking Transformation.

The article has a reference of information from Bankingtech.