- January 13, 2021

- Posted by: Đào Nhật Minh

- Category: Hyperlogy news, Technology news

For many years now most banks have applied a part of the KPI system, but in reality, it still have many problems in the implementation process. Let’s Hyperlogy show you the solution to this problem in the following article.

Characteristics of the banking industry

Large number of employees, many departments / branches, positions, and KPIs

The Bank is a financial institution with a very complex structure, with the participation of thousands of employees in dozens of branches, hundreds of transaction offices, in many functional departments. In each position, how to evaluate performance based on several different KPI. Like other organizations, the goals and the KPI are linked from the Head Office to the branches / divisions, … ultimately to each employee.

Many technology systems with huge databases

A specific characteristic of banking industry is that there are often many technology systems for business such as: Core Bank, Core Card, eBanking, LOS, Cash Management, Website, CRM, ERP, HR, Monitoring / Supporting Software, Call / Contact Center, Smart Form, Smart RM, eKYC, … And the data that each above system records every day is really huge.

Some KPI results are gathered periodically from many technology systems, others are periodically entered through the procedures established by the Bank.

Problems

One of the main reasons why the implementation of a complete KPI system for the entire Bank faced many difficulties is that there are too many discrete evaluation indicators located on many different systems.

Many KPIs, a large number of employees, stratified by work location and departments / branches make it extremely difficult to synthesize and evaluate KPIs according to traditional methods.

This leads to the fact that leaders and managers can only see individual results, can not see the Big Picture because they do not see correlations between indicators. In addition, many KPIs are not tracked in real time. The comparison, trend prediction, problem finding, and cause identification, … have not yet been optimized.

The administrator’s need

To enhance the Bank’s competitiveness in the digital age, leaders and managers want to see the overall picture of their entire system in real-time, with causal linkages, the ability to compare, see trends, help identify problems visually.

Solution

With 18 years of experience in the IT development, Hyperlogy confidently builds an overall and comprehensive KPI evaluation system to help banks optimize costs, improve operational efficiency and bring maximum benefits profit.

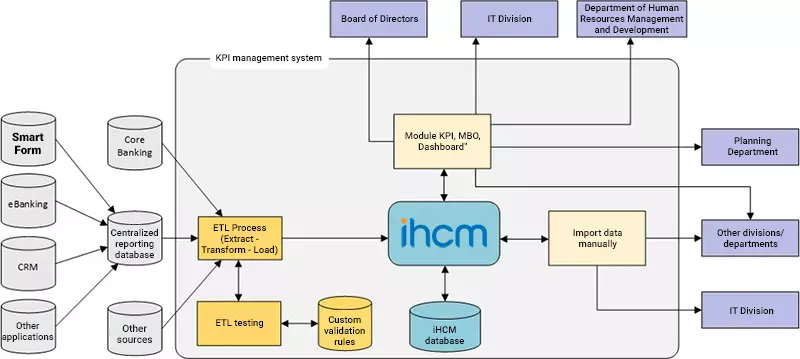

We develop an intermediary system – Smart ETL – This ETL Process (Extract – Transform – Load) is responsible for collecting data from different systems such as Core Banking, Core Card, LOS, CRM, eBanking, data entry, applications, and many other sources… For banks that have implemented solutions located in Smart Digital Bank ecosystem, KPI service data are also collected and aggregated from systems such as Smart Form, Smart RM, Smart Booking, Smart. Auto Bank,… .. One of the typical KPIs for assessing service quality (Service Level Agreement – SLA) for tellers is recorded at Smart Form.

The data pushed into the ETL Process will be synthesized and processed, then standardized, then standardized, and put into the iHCM software for calculating and displaying the KPI results.

After calculating the KPI based on the results and corresponding weights, the system will return the report to the leadership and functional departments. Based on accurate and real-time data, performance evaluation becomes scientific with clear, transparent data to help leaders compare, analyze and make reviews to determine, get the cause of the problem, find solutions to adjust appropriately and improve performance for the whole system.

Applying for other sectors

With the outstanding advantage of high level of security, ensuring information security, the application of iHCM solution – Hyperlogy’s comprehensive KPI evaluation system is completely suitable for deployment in many large enterprises and organizations. Besides the banking sector, insurance, finance, real estate which have similar architecture,… can also apply to implement a comprehensive KPI assessment solution to optimize the performance of businesses. This architecture has actually been applied at Becamex.