- February 8, 2021

- Posted by: Đào Nhật Minh

- Category: Technology news

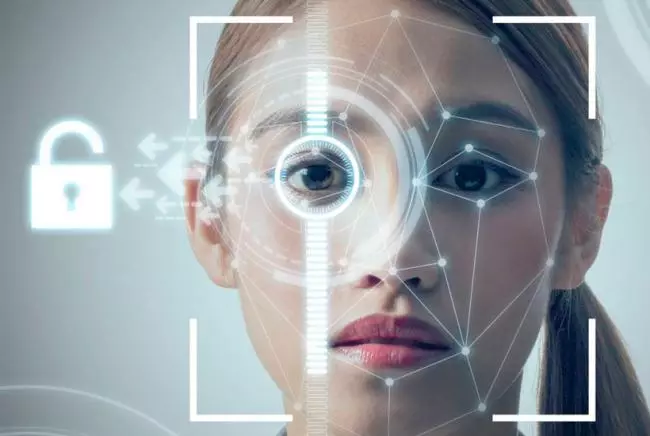

Both banks and customers benefit as fingerprint, iris and facial recognition technology becomes more prevalent in financial services.

As cyberattacks grow more sophisticated, banks increasingly turn to advanced authentication to protect customer data. Widespread biometrics adoption represents not only a top banking trend for 2018 but also a long-term market shift. A report from Global Market Insights predicts that use of the technology within financial services will grow by 22 percent between 2017 and 2024.

That projection reflects the view that passwords — which customers often repeat or simplify in the name of convenience — are no longer a sufficient security barrier.

“If you think about all the breaches and everything going on in the world, passwords need to go away,” Michelle Moore, head of digital banking at Bank of America, told The Charlotte Observer. “No. 1, people forget them. No. 2, they’re not safe.”

Instead, banks see physical and behavioral biometrics as a stronger and more user-friendly means of verifying an individual’s identity. Many have already begun pilots or full-scale efforts to adopt the advanced authentication methods.

Fingerprint Recognition Reigns Supreme

Enabling mobile application sign-on with a simple swipe, fingerprint scanning wears the crown as the most widely leveraged biometric in the industry. The technology first made waves in mobile banking after Apple introduced Touch ID in 2013, and institutions have since found that customers are willing to make the switch.

Bank of America, for instance, rolled out fingerprint authentication and Touch ID in 2015; American Banker reports that more than half of the bank’s customers had used the biometric for mobile access by mid-2017.

“86 percent of banking customers familiar with biometrics had used fingerprint recognition at least once within the last year, while 87 percent of respondents considered the method to be the most secure form of authentication.”

Iris and Facial Scanning Gain Steam

Although Global Market Insights data shows that fingerprint technology will see the most growth by 2024, the report indicates that other authentication technologies will follow suit. The iris recognition market, in particular, will see double-digit growth between 2017 and 2024.

According to Fortune, dozens of regional banks and credit unions already enable app sign-on via eye recognition. Wells Fargo offers an eye-scan option to corporate clients, with intentions of expanding the feature to all customers in the near future. And Bank of America partnered with Samsung last August to begin testing the technology.

Facial recognition, also on track for growth across industries, is seeing a boost from the launch of Apple’s Face ID system. Banking customers with an iPhone X can so far use Face ID to log in to mobile apps from the likes of U.S. Bank and Citibank, but other institutions will probably explore the technology, given that iPhone X doesn’t support Touch ID.

Biometrics Support Multilayered Security, Customer Experiences

With so many options available for biometric identification, banks could choose to mimic multifactor authentication and require users to provide a combination of biometric identifiers to reduce the potential of fraud even further.

For now, though, banks such as Wells Fargo offer multiple options to make the process more flexible for customers. “One biometric doesn’t fit every situation,” Steve Ellis, head of Wells Fargo’s innovation group, said in an interview with Tearsheet. “For example, if I’m driving in my car and I want to talk to the bank, I’m not going to authenticate with my fingerprint, but maybe my voice could be the password.”

With that kind of innovative, customer-focused thinking taking place at institutions across the country, it’s clear mobile banking is entering a new era of security and convenience.

Quickly grasp the digital transformation needs of the finance – banking – securities – insurance industries, and want to quickly reach young customers who love technology and are in need of small amount of money, Hyperlogy has applied Biometrics to develop the MOBILE eKYC solution. Customers will not have to go to the transaction office, only need to authenticate by facial recognition, fingerprint combined with scanning information on personal papers such as citizen’s ID, ID card, driver’s license or passport … on personal mobile device. When the data is the same, they can easily access to small financial loans / banking transactions. MOBILE eKYC has high applicability, fast authentication, and enhanced user experience.

Besides, Biometrics is also one of the core technological factors that we developed to build SMART eKYC PLATFORM – the core foundation forming the SMART DIGITAL BANK ecosystems for the banking industry or SMART DIGITAL GOVERNEMENT for the public service sector, and there are more in-researching ecosystems that can be applied in many other fields: Retail, Insurance, Securities, Tourism …

(Reference: https://biztechmagazine.com/article/2018/03/how-will-biometrics-affect-future-banking-security)