- December 12, 2018

- Posted by: Đào Nhật Minh

- Category: Hyperlogy news

In parallel with the Block-chain solutions, P2P Lending solutions, etc., Online Customer Identification (called “eKYC”) is becoming an indispensable growing trend in the digital age when the digital economy becomes more and more apparent.

Currently, a lot of Vietnam commercial banks have requested the State Bank of Vietnam to allow applying eKYC (Electronic Know Your Costumers). Mr. Nguyen Duc Huy, Deputy Director of Digital Banking Division of Military Bank (MB Bank) said: “A digital bank grows well if the registration is easy. eKYC is what we expect to help our customers experience better.“

Banks – “electronic Know Your Customer” succeed with SMART eKYC

Based on the demand for identifying customers online of Banking and Finance, Hyperlogy Coporation has focused on researching and investing in the most advanced technologies to develop SMART eKYC product.

With this solution, instead of identifying customers through face-to-face meetings and the reconciliation of paper documents with the tellers, banks can perform Electronic Customer Identification at the time customers come to the bank due to the support from the most advanced technology such as checking, reconciling personal information instantly with a centralized database of user identities, identifying customers using bank cards, identification papers through Neural network technology.

Linked to SMART FORM solution, SMART eKYC will help banks, financial institutions save time, money and manpower for transactional work, and provide customers with a better banking services.

Biggest benefits of SMART eKYC when deployed in banks

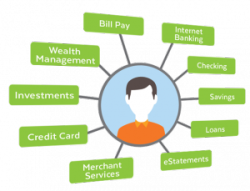

Know Your Customer 360

Through SMART eKYC, the Teller / Controller will know: Have customers already have an account? What services are they using? Trading activities? Are Regular or VIP customers? How reliable is the customer? Moreover, you can predict what your customers might be in need of? From there, the bank can build a 360 chart of customer portrait based on the identifying criteria in order to maximize benefits from customers, giving priority to VIP customers faster, Cross-sell, Up-sell, especially with existing customers, because the cost of finding new customers is much higher than cost of retaining old customers.

Through SMART eKYC, the Teller / Controller will know: Have customers already have an account? What services are they using? Trading activities? Are Regular or VIP customers? How reliable is the customer? Moreover, you can predict what your customers might be in need of? From there, the bank can build a 360 chart of customer portrait based on the identifying criteria in order to maximize benefits from customers, giving priority to VIP customers faster, Cross-sell, Up-sell, especially with existing customers, because the cost of finding new customers is much higher than cost of retaining old customers.

A 15-fold Increase in Productivity

A 15-fold Increase in Productivity

We can’t deny the support role of machinery, modern technology in enhancing staff productivity in bank. With SMART eKYC, transaction staff will ease the pressure at the counter, faster operation and always smile with customers.

One-minute Transaction

SMART eKYC – The key to enhancing customer’s experience. No need to queue, fill in forms, papers, customers are served faster when they are properly identified and divided into the transaction desks, even, when combined with BANK Internet Check-in, SMART eKYC will meet the transaction needs of millions of customers and does not take too much waiting time.

SMART eKYC – The key to enhancing customer’s experience. No need to queue, fill in forms, papers, customers are served faster when they are properly identified and divided into the transaction desks, even, when combined with BANK Internet Check-in, SMART eKYC will meet the transaction needs of millions of customers and does not take too much waiting time.

Bringing customers with superior new experiences, providing real-time services and cutting operational costs for banks in 2018 are benefits forecasted by LPB Research, banks will take stronger steps in the research and application of digital banking.

Banks enjoy the most advanced technology when applying SMART eKYC

SMART eKYC is the product that Hyperlogy is so proud of owning its breakthrough technology, application of Artificial Intelligence, Deep Learning, and Process Automation.

With its compact dimensions, modernest design, and versatile functions, SMART eKYC is perfectly suited for all types of transaction offices, bank branches of all sizes. As such, SMART eKYC acts as a modern, customer-friendly, highly secure transaction channel.

In addition to SMART eKYC, Hyperlogy has also introduced the MOBILE eKYC solution – A Product of Electronic Customer Identification through Biometrics. This suite of solutions promises to help the bank assert its position in the regional and global retail banking system.

SMART eKYC and MOBILE eKYC were introduced by Hyperlogy at the Conference – Vietnam Retail Banking Forum 2018 on 29/11/2018. You can see the brochure for the SMART eKYC solution here.

ARE YOU READY TO EXPERIENCE eKYC – MOBILE eKYC along with Hyperlogy?

According to McKinsey, in the world, banks will have 3 to 5 years to develop digital banking if they do not want to be excluded from the retail chain. A report from Forrester also said that more than 80% of banks recognize that “Digital Banking Transformation” is the key to their future success, and this transition should happen soon.

IF YOUR BANK IS ONE OF THE + 80% OF BANKS IMPLEMENING THE TOTAL DIGITAL TRANSFORMATION STRATEGY, PLEASE CONTACT US NOW TO KNOW MORE AND GET A DEMO OF SMART eKYC – MOBILE eKYC!